TOP TIPS

COMMON CRYPTO SCAMS

PLEASE READ VERY IMPORTANT SHIT

TOP SCAMS EXPLAINED.

WHAT ARE PONZI SCHEMES?

As the cryptocurrency market continues expanding, it is definitely necessary to know what Ponzi schemes are. As developers and projects are trying to gather funds through token sales, Ponzi schemes might also seem to be legitimate. But these schemes are simply frauds. They are trying to steal our money.

In this post, we will discuss all the information you should have about Ponzi schemes. We will share with you what they are, how to avoid them and how they are staling users’ funds.

What are Ponzi Schemes?

Ponzi scheme is the name given to a kind of fraud that uses new investors’ money to pay profits to new investors. For example, a crypto company may be promoting a token that promises profits to users that buy this asset.

Once the users purchase the asset, they will start receiving funds. Thus, everything seems normal and even very positive. The profits are very high and the experience is very smooth. In general, there is going to be a lot of promotion on social media of this project. This would make investors believe the crypto company is growing and doing a good job.

Despite that, the profits paid to the first investors are going to be paid with the funds deposited by newer investors. As long as new investors place their funds into this company, the profits can be paid and the illusion of success can continue.

The users of these platforms and crypto projects believe that they are earning legitimate funds from business operations. However, all of the funds (or most of them), are going to come from new investors. If older investors claim all of their funds, the Ponzi scheme may not last for a long period of time.

The owner of the Ponzi scheme is going to be sharing with investors regular reports of their funds and profits. They will also be pushing investors to “re-invest” their funds rather than cashing them out.

How to Spot Ponzi Schemes?

There are some red flags that would allow us to understand whether a project could be a Ponzi scheme. In this section, we are going to share these red flags with you:

Large (sometimes unbelievable) Profits – If you are promised to get massively large profits (“Get 500% profit on your investments in 5 days!)

Not regulated companies – if the company does not have a regulatory license in some of the most regulated countries, this should be considered a red flag

They push you to re-invest your funds – they push you to re-invest your funds even when you want to cash out

Issues trying to cash out – if you are finding issues to cash out, then you should be concerned about it

Lack of basic information – some Ponzi schemes are created in just a few days. If you have been denied basic information, then this should be considered a red flag

Complex and sometimes not logical investment strategies – Ponzi schemes will be using complicated terminology or complex investment strategies. If you find they are offering investment strategies that do not seem logical, then ask more questions and ask for further information.

Karatbars

Karatbars is certainly considered to be one of the largest Ponzi schemes that have been operating in recent times. This company has been promoting through strong marketing campaigns and multi-level affiliations the KBC coin.

According to the firm, the KBC coin is blacked by real gold that is held by the company. Users can buy KBC coins knowing they are backed by real golds. This is how a stablecoin would work but with a fiat currency. Nevertheless, there are many differences between Karatbars and traditional stablecoins in the market.

Karatbars is promoting the project through a multi-level affiliate program that is already one of the red flags we need to take into consideration when analysing whether a project is a scam or not.

Another point to mention is that the only way to get the gold is by using a KBC ATM. These are traditional ATMs that are branded with the Karatbar logo and that provide users with “cash gold.” The main issue with these ATMs is related to the fact that there are few or almost no ATMs installed. This makes it difficult, if not impossible for users to withdraw their funds in gold.

In addition to it, the company has already been investigated by several regulatory agencies around the world. Canadian regulators have banned the company and its affiliates in the country. Meanwhile, the Bank of Namibia has also announced that the company was not suited to operate in the country.

The real way to make money for this company is to attract a larger number of investors that will place their funds into this ecosystem and attract a larger number of users as well.

Forsage

The Forsage Ponzi scheme has also been attracting a large number of users to its platform. The Ponzi / Pyramid scheme has pushed investors to search for new ways of investments in the DeFi market.

The company was able to gather around $3 million in Ethereum (ETH) funds during the last few days. Users are attracted by investing a small amount of ETH (0.05) and then they are promised to receive profits according to the new users they bring to the platform.

Forsage claims that the more partners that participate, the more money is collected. Consequently, they are able to continue operating. Several cryptocurrency experts and analysts have warned against Forsage. Even the Securities and Exchange Commission of the Philippines has warned investors about Forsage.

In addition to it, the project does not have a license to operate and it is considered a Ponzi scheme where investors are paid using the contribution of new investors. This shows how this Ponzi scheme is growing, how users are making money (the first investors) and how the newcomers are going to lose their investments as soon as there are no new users ready to place their funds into this scam.

While many consider it is an opportunity of a lifetime, understanding which are the basic points of a crypto Ponzi scheme will help you to distinguish whether a project is legit or not.

WHAT ARE PYRAMID SCHEMES?

There are several projects in the crypto market that are offering new opportunities to users to invest their funds. However, not all of them are 100% legitimate. There can be pump & dump schemes, Ponzi schemes and also pyramid schemes.

In this guide, we will discuss what Pyramid schemes are, how to detect these scams and why you should remain far away from them. Before we start, we need to tell you that these schemes are illegal in different countries because they end up negatively affecting investors.

What are Pyramid schemes?

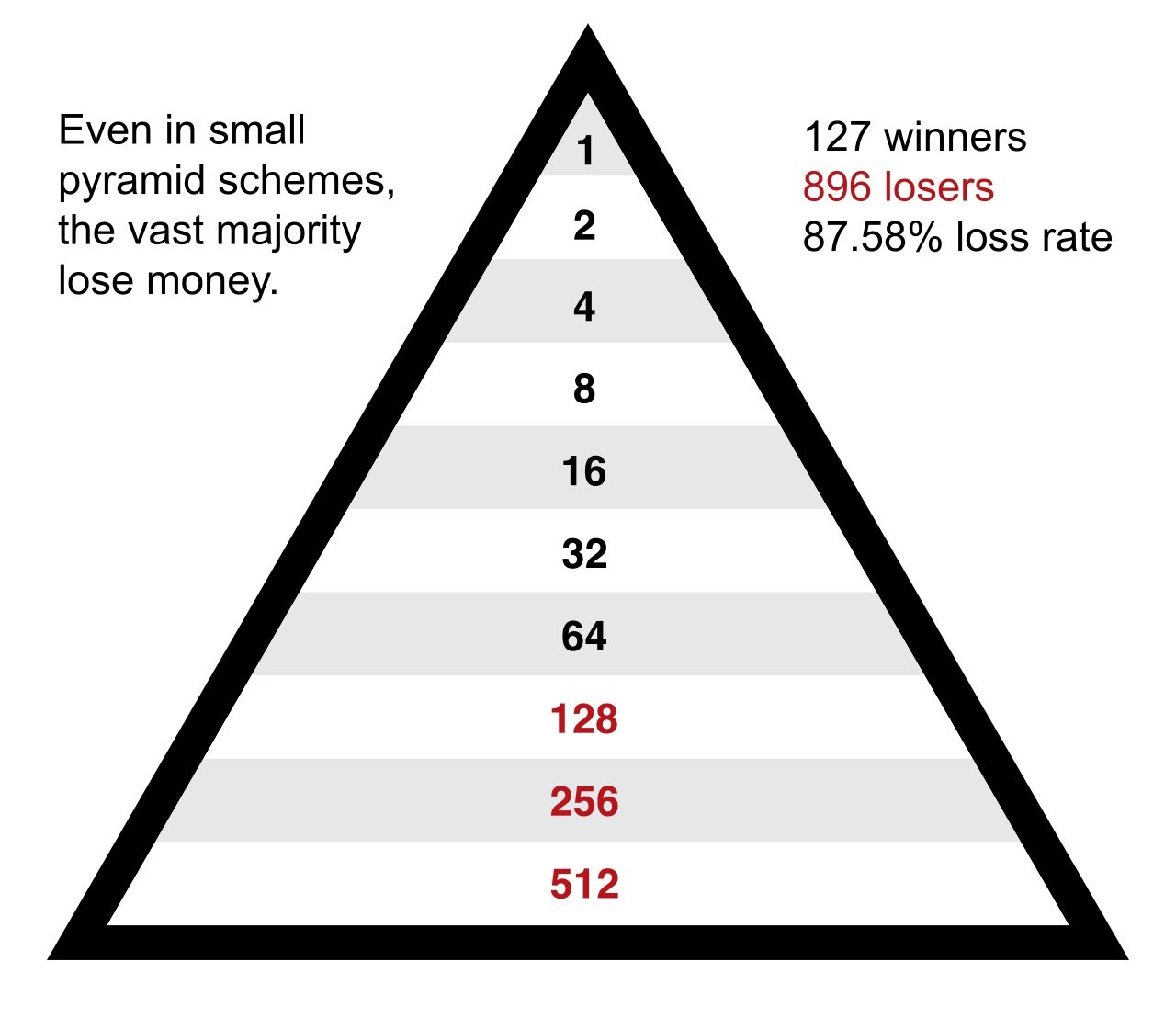

As the name suggests, we are talking of crypto projects with different investment levels. In general, these schemes have the shape of a pyramid, where the first investors are at the top and the last investors are at the bottom.

The pyramid schemes use a business model that works by pushing users to recruit new users that would bring investments and keep the cash flowing into the first users that entered the pyramid scheme. These projects do not tend to re-invest the funds collected, but instead, they completely rely on the investments of new users to keep the business going. Nevertheless, all the pyramid schemes are unsustainable and they will fall sooner or later.

How Does a Pyramid Scheme Work?

The organizer of a pyramid scheme will be searching for early investors that will place their funds in the project. In general, the organizers offer high returns and even larger profits to users that are able to bring new clients.

Those that are at the top of the scheme (those that invested first) may be able to receive some of the funds and profits that were promised. But as soon as second or third-line investors start asking for their funds and withdrawing their money, the pyramid starts falling apart.

In order for a pyramid scheme to be financially successful, it would require an infinite number of individuals that would keep pumping money into the project. However, there is a problem with this, considering there are not enough people on earth to keep doing so indefinitely.

In general, each recruiter should bring two new investors to get his investment boosted or get any profit. In this way, the new two recruiters will try bringing 4 people in total, and these 4 individuals would try convincing 8 investors to place their funds in the project. This goes on until there are no more users to attract, and the pyramid falls.

Bitconnect

Bitconnect was one of the largest Pyramid / Ponzi schemes in the cryptocurrency world. This platform was able to gather investments from a large number of investors from all over the globe. The BCC native token to this platform skyrocketed to $500 in 2017 and then plummeted to just $1.

This shows how hard it can be for investors to place their funds in a Pyramid Scheme such as Bitconnect. The platform was offering investors an “investment plan” where users deposited Bitcoin (BTC) and they received Bitconnect Coin (BCC).

After it, they were able to lock their coins and earn interest that was calculated daily. The company claimed they were using a system based on a trading bot that provided users with regular interest.

It is worth mentioning that Bitconnect was working for several years, showing that the first users to invest in this project were actually making profits. However, the last investors that joined this scam in 2017 were mostly affected and lost their investments.

Bitconnect has also been warned many times by authorities from different countries to prove it was solvent. Despite these warnings, it was not possible for the firm to show it was operating legitimately and offering users a reliable source of income.

The founders of the platform have never been captured by law enforcement agencies. However, some individuals connected to this Pyramid scheme have been arrested in India

Red Flags

If you are a crypto investor, you should take into consideration some red flags that would allow you to detect pyramid schemes.

They promise to give you “financial freedom.”

Some of them may tell you that you “will not work anymore”

Rewards are usually high and profits tend to be higher than normal investments

They ask you to contact more users to get your investment back

There is no clear product or service offered

One of the most common pyramid schemes in the market include Multi-Level-Marketing (MLM)

DAILY EARNING SCAMS

If you have been contacted to earn money on a daily basis in the cryptocurrency market, then this should raise a red flag. Daily earning scams have been expanding in recent years. The first thing you need to know is that there are no magic solutions to make money. No matter if they tell you they have a “revolutionary” or “secret” method. Just avoid these scams.

This is the reason why we have prepared this bunker guide. We want to make sure you stay far away from daily earning scams. We will share with you all the information you should have about these scams. Moreover, you will know how to recognize them and avoid them.

What are Daily Earning Scams?

Daily earning scams are fraudulent schemes that attract users by offering them a daily income. Most of the newcomers to the market can think this is part of a revolutionary or unique system. However, this is not the case.

Most of the daily earning scams are simply fraudulent businesses that steal users’ funds by promising them daily rewards. These scams will tell investors they have a unique business model that allows them to reward users with daily dividends.

However, to earn money in the cryptocurrency market (or any other industry), you will have to work hard. There are no magic solutions to earn daily income without working.

How to Recognize these types of Scams?

There are different ways to recognize daily earning scams. Here we give you a list of things you should take into consideration to recognize these fraudulent scammers:

These projects offer you highly lucrative daily rewards if you invest money with them

They usually allow you to have “higher earnings” if you bring new investors

They will create problems once you want to withdraw your funds

These scams will always give you another reason not to leave their investment scheme

Newer users are having issues with withdrawals

They require you to block your investment for a long period of time

They push you to buy their own token

They are considered to be pyramid or ponzi schemes

Of course, there are many other characteristics that would raise red flags as well. For example, these daily earning scams tend to promote their project with massive marketing campaigns. Most of the good projects do not have to promote their businesses with massive ad campaigns.

Moreover, the rewards offered by traditional investment businesses are realistic. Daily earning scams will promise you high rewards through their “innovative” solutions that they have discovered.

Examples

One of these projects was the so-called BitClub Network. The creators of this project promoted their solution by asking investors money in exchange for shares in crypto mining pools. BitClub Network expanded by requesting users to bring new investors. In this way, they were able to operate for several years in the cryptocurrency market.

The company was then changing its Bitcoin mining figures. This allowed them to attract a larger number of users and show that they were “profitable.” The BitClub Network stopped operating in 2019 when authorities shut down this daily earning scam.

BITCOIN AND CRYPTOCURRENCY MINING SCAMS

The cryptocurrency market has been a place where scammers and fraudsters became very active trying to steal users’ funds. Cryptocurrency mining scams expanded in the last years and it affected users from all over the world. In this guide, we will explain what Cryptocurrency mining scams are and how you can avoid them.

What is Cryptocurrency Mining?

Cryptocurrency mining activities are a very important part of the crypto market. They allow new coins in different Proof-of-Work (PoW) networks such as Bitcoin, to be created.

In order to do so, you can rent mining hardware from companies (which is called cloud mining) or you can simply mine virtual currencies with the mining hardware you acquire. Due to the large cost of installing a Bitcoin mining rig, users prefer o use cloud mining services.

What are Bitcoin and Cryptocurrency Mining Scams?

Cryptocurrency mining scams make reference to schemes that push users to invest in crypto mining companies or hardware with the promise of making large amounts of money. Some firms could provide users with the promise of earning large sums of BTC or other PoW networks by purchasing unique and powerful mining rigs.

However, these are simply scams that are trying to steal users funds. One of the ways these cryptocurrency mining scams work is by having “hidden fees” when you mine digital assets. These projects will claim that these fees were previously disclosed and you would not be able to do anything against them. Your mining hardware (cloud or physical) would not pay off the investment you made.

Another way in which they can scam users is by simply lying about their services. While expert crypto users might be able to identify cryptocurrency mining scams, newcomers may find it difficult to understand which are genuine services. Thus, they end up buying cloud mining subscriptions or mining hardware that simply do not work.

This is why it is always important to know that only the largest cryptocurrencies in the market will allow you to generate gains through crypto mining. Instead, if you want to mine cryptocurrencies, the best thing to do is to search for the most popular and recognized services providers rather than small and recently created firms.

Mining Max Scam

One of the largest mining scams in the crypto market was the South Korean Mining Max. This platform promised users to get large ROIs through an innovative cryptocurrency mining project. Users that brought new clients to the platform were rewarded with higher ROI.

You can check our guide related to Ponzi Schemes clicking here.

However, this firm was just stealing users funds and enriching the first investors. More than $250 million in funds were gathered by this firm. Most of the users were located in South Korea, the United States, China and Japan.

Cryptocurrency Mining Scams Red Flags

These are some of the things you should take into consideration to recognize a cryptocurrency mining scam:

They offer large (and sometimes unbelievably large) ROI

Crypto mining scams promise users to mine a wide range of virtual currencies

Individuals are requested to recruit new members to increase their ROI

Withdrawals do not work properly

There are delays with the physical delivery of mining hardware

Cloud mining services would have very high hidden fees

They may claim you didn’t surpass the minimum mining threshold to withdraw funds

All the things that could look suspicious should make you consider whether this is a scam or not. You should always make your own due diligence and understand where you are investing your funds.

At The Crypto University, we do not recommend Cloud Mining at all. You should take care of your funds and avoid being involved in scams.